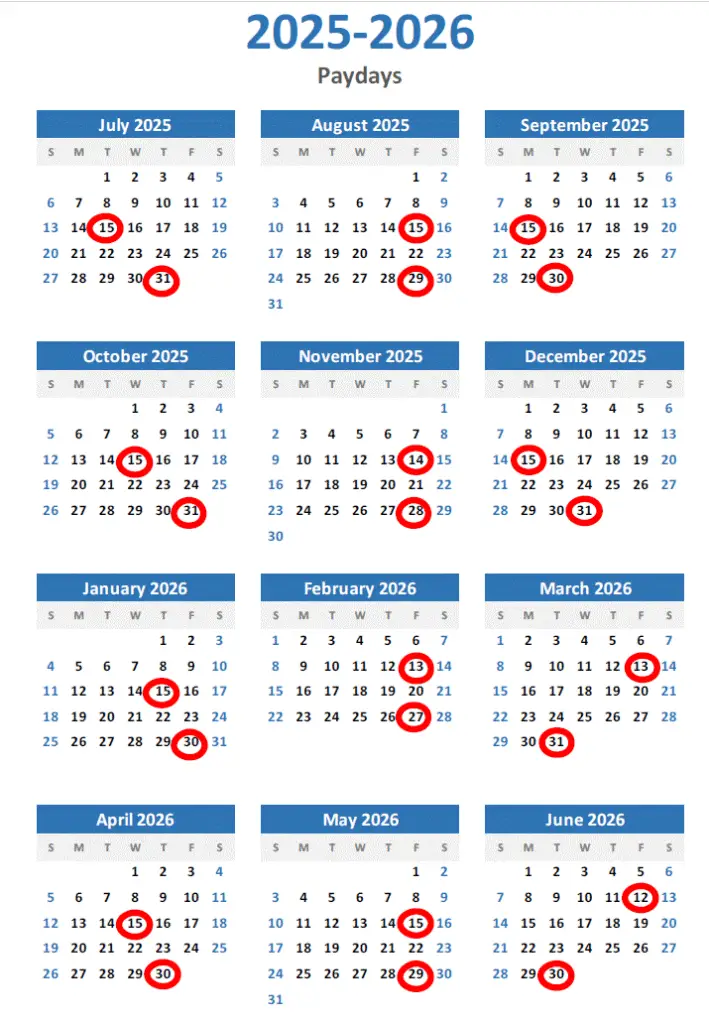

Payday is the 15th and the last weekday of the month.

- Directory

| Name | Phone | |

| Department Main Line | (801) 826-5595 | |

| Shana Lowe | (801) 826-5424 | |

| Shannon Mortensen | (801) 826-5433 | |

| Kathy Aitken | (801) 826-5326 | |

| Janet Pearson | (801) 826-5342 | |

| Lana Deuel | (801) 826-5513 |